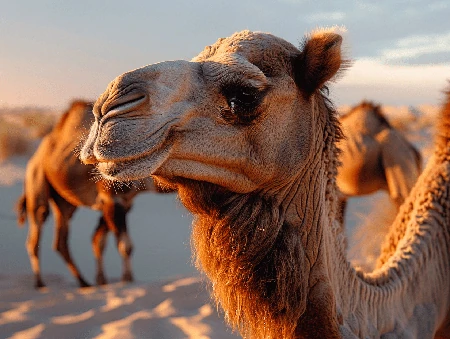

Travel Insurance when Camel Trekking and Camel Riding

There may be cover for camel trekking and camel riding under all international travel insurance policies.

Please refer to the Product Disclosure statement to view PDS, FSG and all General Exclusions.

Camel trekking and camel riding with travel insurance

Travel insurance when camel riding:

Travel Insurance Saver offers a variety of online travel insurance plans that may provide cover for camel riding. Camel riding is not generally excluded under the available travel insurance plans, though is subject to other general exclusions and policy conditions and limitations. These plans cater to various travel needs and include overseas medical expenses and different amounts for medical evacuation and repatriation.

Travel insurance cover is based on the event and subject to exclusions, conditions, or limitations as per the combined FSG and PDS by Travel Insurance Saver. No cover is provided for professional sports or adventure activities.

Some conditions may apply to travel insurance when Camel Riding:

Cover may be available for camel riding/trekking related events depending on the event. Claims are assessed on a case-by-case basis. Camel riding/trekking is not generally excluded under the Travel Insurance Saver policy. However, other general exclusions, conditions and limitations may apply. To know what you are and are not covered for, make sure you have fully read and understood the Product Disclosure Statement.

Travel insurance when Camel Riding with existing medical conditions:

For travellers with existing medical conditions planning to partake in camel riding, an online existing medical condition screening is required to be completed to determine if the condition can be covered. If you have an existing medical condition, you will be required to complte an online medical screening.

Travel insurance with cover for different destinations:

Camel riding destinations like Morocco, Egypt, United Arab Emirates, Jordan, India, Oman, Australia, Mongolia, and Tunisia offer unique experiences. For those needing cancellation cover for prepaid camel riding arrangements, selecting a plan with optimal cancellation and holiday deferment cost cover is advisable.

Travel insurance when Camel Riding with an Annual Multi-trip plan

For multiple camel riding trips in a year, the Annual Multi-Trip plans may provide travel insurance cover for the aforementioned destinations when selected during the quote process.

Travel Insurance Saver's online plans also cover a wide list of destinations, provided they are selected when obtaining a quote. However, destinations with a 'DO NOT TRAVEL' advisory from the Australian Government are excluded from travel insurance cover.

Cover is subject to the policy terms, conditions, and limitations and exclusions set out in the Product Disclosure Statement. Always read the Product Disclosure Statement before making a decision about any travel insurance policy.

Contact Travel Insurance Saver

If you have any question's please fill in the form below and one of our friendly team members will get in touch soon.